As the new fiscal year approaches, California residents and property owners are eagerly awaiting the announcement of the inflation factor for 2025/26, as mandated by California Proposition 13. This crucial piece of legislation, passed in 1978, has been a cornerstone of the state's property tax system, limiting the growth of property taxes to a maximum of 2% per annum, unless the property is sold or undergoes significant renovations. In this article, we will delve into the details of the California Proposition 13 inflation factor for 2025/26, its implications, and what it means for property owners across the Golden State.

What is the Inflation Factor?

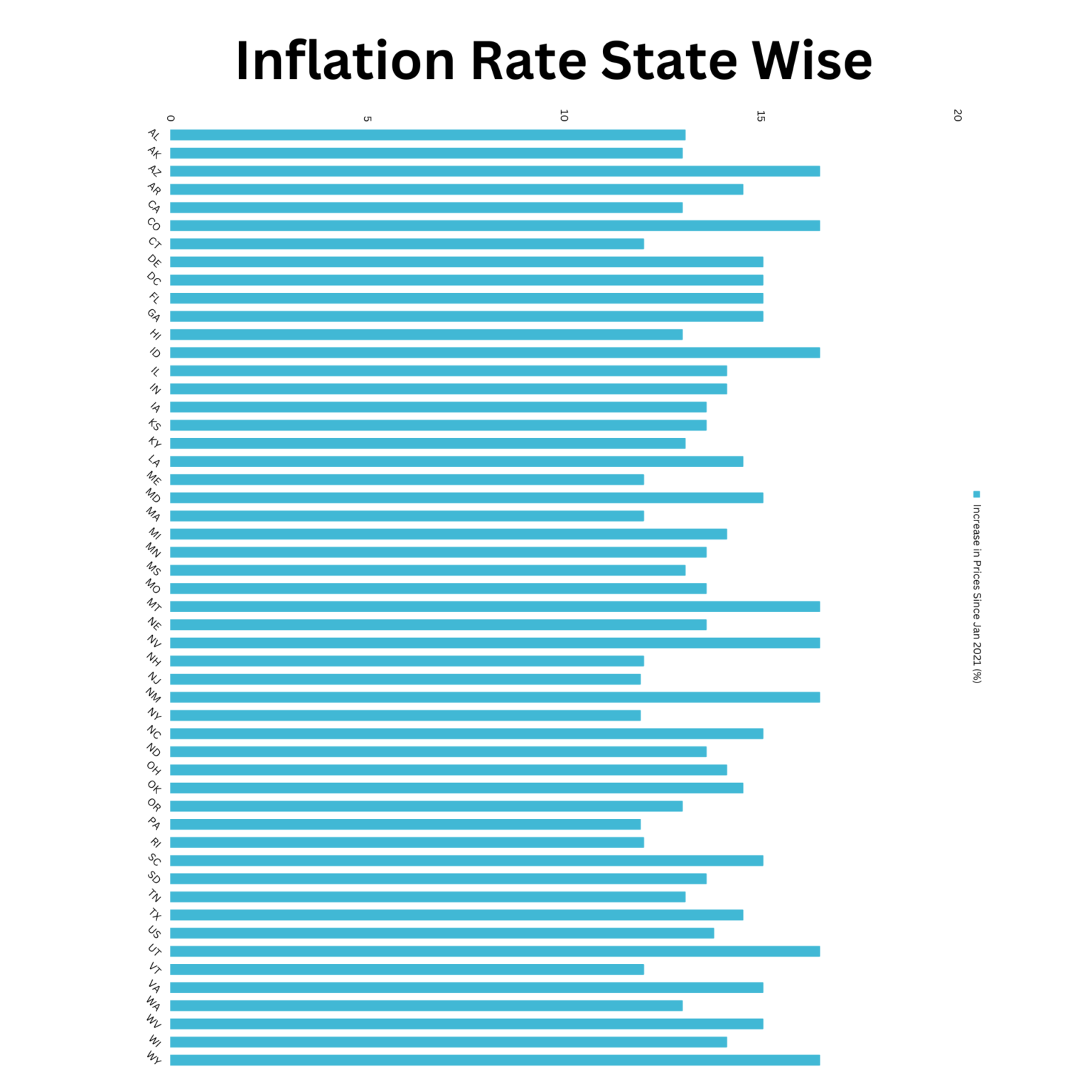

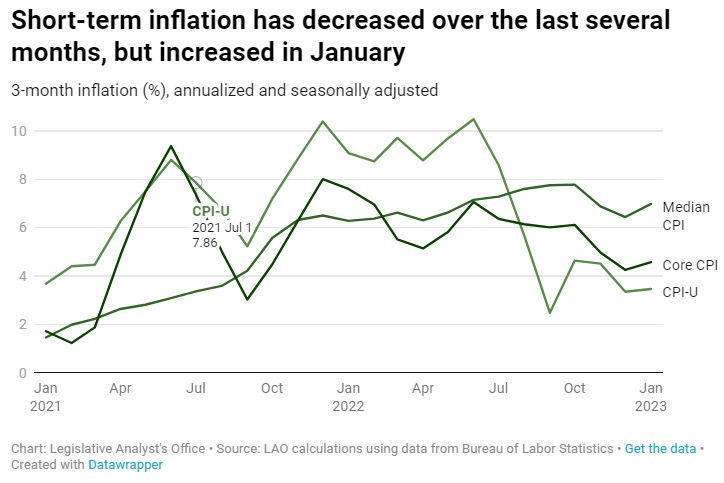

The inflation factor, also known as the California Consumer Price Index (CPI), is a critical component of Proposition 13. It is used to adjust the maximum allowable increase in assessed value of properties, ensuring that property taxes do not rise exponentially with inflation. The CPI is calculated annually by the Bureau of Labor Statistics and is based on the average change in prices of a basket of goods and services consumed by households.

California Proposition 13 Inflation Factor for 2025/26

According to the California State Board of Equalization, the inflation factor for 2025/26 is expected to be around 2%, although the final figure will be announced in the coming months. This means that the assessed value of properties in California can increase by a maximum of 2% for the 2025/26 fiscal year, unless the property is sold or undergoes significant renovations.

Implications for Property Owners

The California Proposition 13 inflation factor for 2025/26 has significant implications for property owners across the state. With a 2% increase in assessed value, property taxes will also rise, although the actual increase will vary depending on the location and type of property. For example, a property with an assessed value of $500,000 in 2024/25 will see an increase of $10,000 in assessed value for 2025/26, resulting in a higher property tax bill.

In conclusion, the California Proposition 13 inflation factor for 2025/26 is a critical component of the state's property tax system. With a expected increase of 2%, property owners can expect a moderate rise in their property tax bills. However, it is essential to note that the actual increase will vary depending on the location and type of property. As the final inflation factor is announced, property owners should review their tax bills carefully and seek professional advice if necessary. By understanding the implications of the California Proposition 13 inflation factor, property owners can better navigate the complex world of property taxation in California.

For more information on California Proposition 13 and the inflation factor, please visit the California State Board of Equalization website. Additionally, property owners can consult with a tax professional or attorney to ensure they are in compliance with all applicable laws and regulations.

This article is for informational purposes only and should not be considered as tax or legal advice. If you have any specific questions or concerns, please consult with a qualified professional.